The UK’s EV Battery Backlog: Risks, Costs, and the Path to Circular Recycling

A swelling backlog of end-of-life batteries now sits in UK warehouses, exposing weak links in collection, testing, reuse, and recycling. The numbers keep rising, while fire risks and costs grow. This challenge is about safety, workable economics, and building a circular system that functions at scale. With clear rules, reliable data, and domestic refining, the UK could turn today’s liability into long-term value.

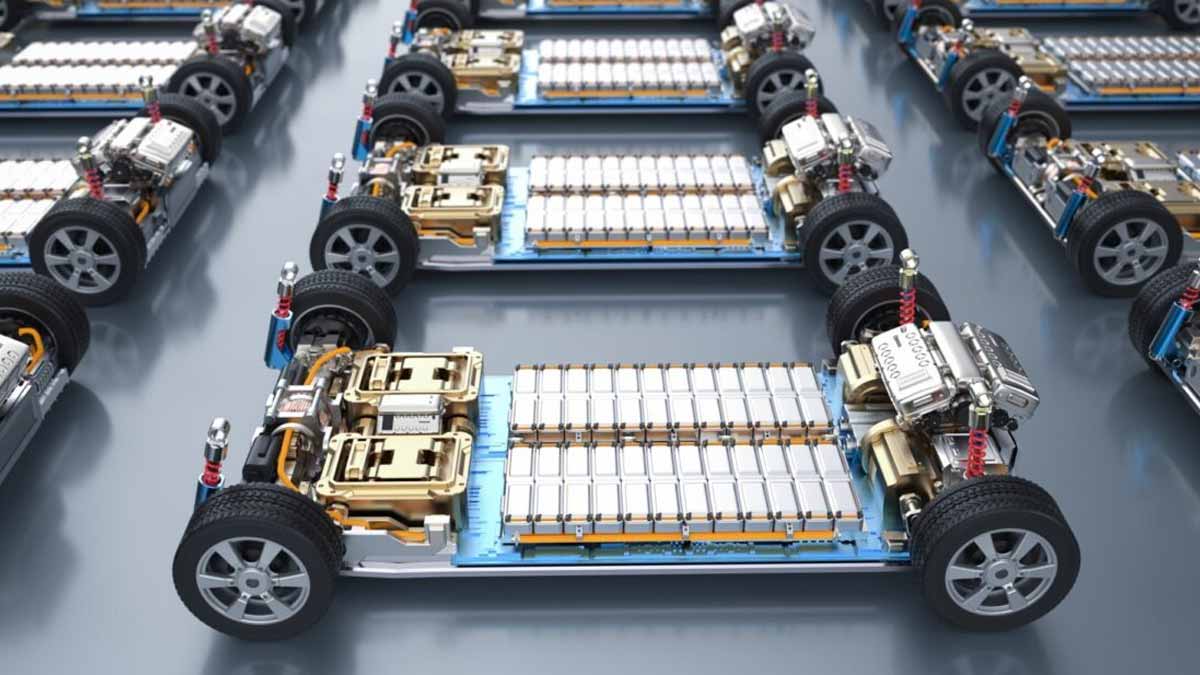

Why the UK Has a Growing End-of-Life EV Backlog

Industry estimates suggest around 23,500 retired EV and storage batteries are in Britain, with as much as 90% stored rather than reused or recycled. These units include early EV packs, accident write-offs, and large volumes from stationary energy projects.

The backlog exists because the chain is fragmented. Testing, shared data, and clear responsibilities are missing, slowing triage and driving up storage costs. Fire risk increases as packs age, while second-life projects struggle without standardized formats and warranties. Executives warn that volumes are finally large enough for viable recycling—but only if systems scale quickly.

How Batteries Move From Collection to Bottlenecked Recovery

In theory, batteries should flow through collection, testing, safe discharge, and either repurposing or recycling. The UK can shred packs into “black mass,” a concentrate of valuable metals, but lacks a domestic refining step. This forces exports, adding cost, delay, and paperwork.

Landfilling lithium-ion packs is banned. Hazardous-goods rules govern every shipment, and insurers scrutinize movement due to fire risks. Salvage streams complicate oversight, with unverified resales appearing online. Carmaker programs help consolidate supply, but without UK refining, bottlenecks persist and costs remain high.

Safety, Costs, and Value Pressures in Storage

Fire safety is the biggest concern. Damaged or aging modules can fail suddenly. Some fleets store units in simple shipping containers, which heightens danger. Meanwhile, storage costs mount with compliant packaging, trained transport, monitoring, and specialized insurance. When metal prices fall, processors slow intake rather than operate at a loss.

Standardized test data would speed throughput by giving second-life buyers confidence and letting lenders underwrite projects. With traceability, unsafe resales shrink and responsible operators move faster. Better data and shared liability frameworks could help balance costs and accelerate flow.

When Low-Value Chemistries Stall Recycling

Market dynamics shape decisions. Lithium prices dropped after 2022, cutting value. LFP batteries, common in newer EVs, contain little nickel or cobalt, making economics weak when lithium is cheap. Processing and logistics can outweigh recovered value, leading operators to stockpile until conditions improve.

Exporting black mass adds friction—hazardous cargo paperwork, limited routes, and high insurance. Domestic refining would shorten timelines, cut costs, and keep value onshore. With higher volumes, unit costs drop and yields improve, but investment depends on stable revenues and predictable offtake contracts.

What Fixes Could Turn Risk Into Circular Value

Operators describe a “latent stockpile” ready to feed real recycling lines, not just pilots. Three major shifts would unlock progress: standardized testing protocols, digital battery passports, and insurance aligned to real—not assumed—risk.

Governance also needs to catch up. Patchy rules create confusion and gray markets, with unverified packs sometimes resold online. Clear enforcement would improve safety and confidence. Carmaker programs help, but Britain also needs commercial refining capacity to keep black mass at home. With better diagnostics and bankable warranties, second-life projects like storage and charging can expand.

A Realistic Path Forward

The UK can turn today’s risky backlog into an opportunity. That means building domestic refining capacity, standardizing diagnostics, and aligning insurance with verified data. With those steps, batteries stop being a storage liability and instead fuel a circular economy that supports jobs, reduces imports, and makes transport cleaner. The backlog is real—but so is the potential to turn it into value.